6 minutes read

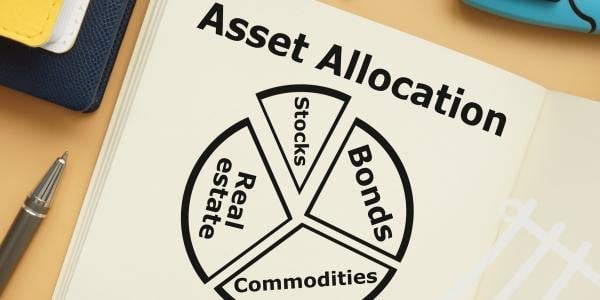

Are We Mistaking Index Performance For Diversification?

Contributed by: Nicholas M. Brown, CFA, CFP®

The S&P 500 has delivered strong performance over the past three years. After navigating inflation shocks, aggressive rate hikes, and recession concerns, it has rewarded investors who stayed disciplined. For many, that resilience reinforced a simple narrative: stay invested in the index and let compounding do the work.

Yet 2025 introduced a quieter development.

While…

Rollovers (1).png)

.png)

.png)