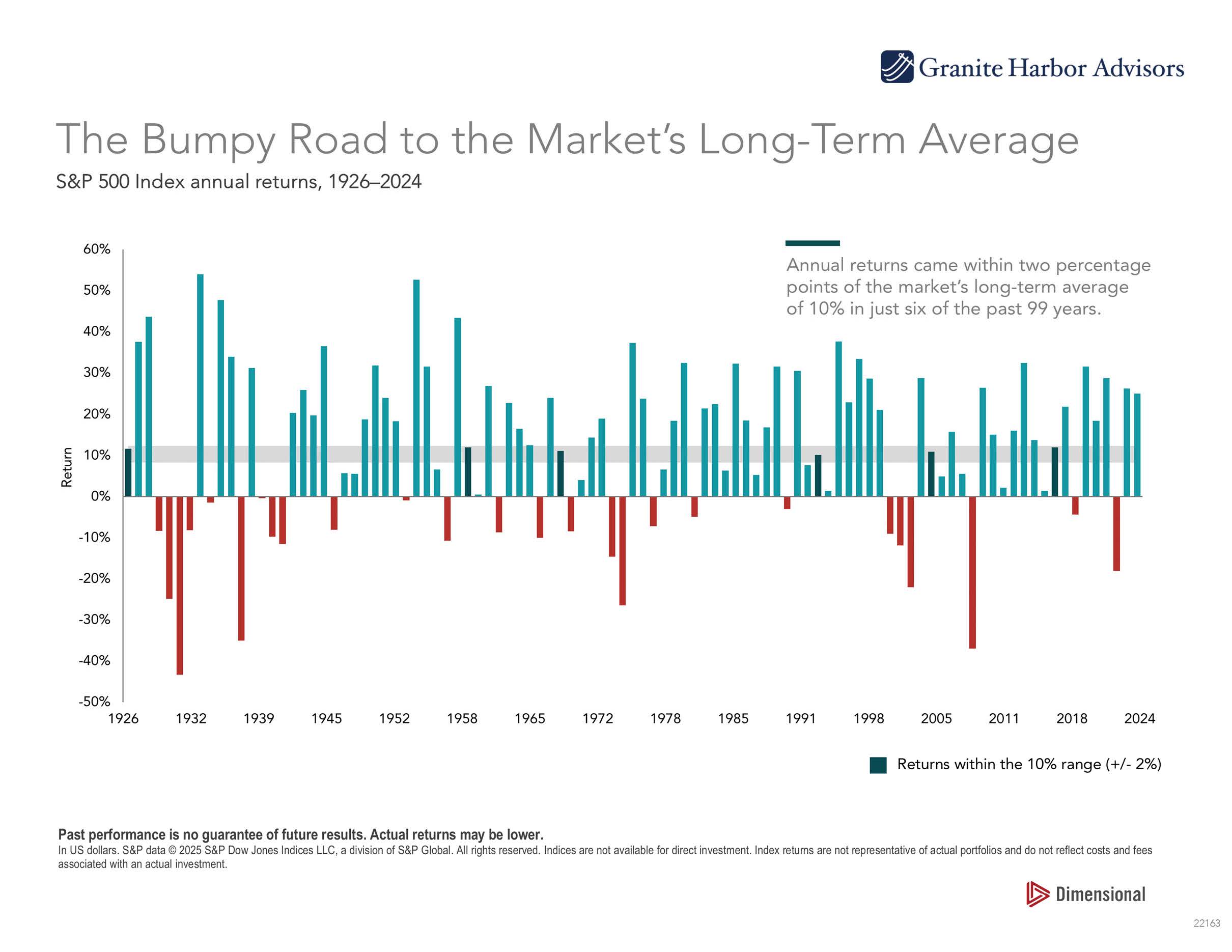

Since 1926, the U.S. stock market has served as a powerful engine of wealth creation, delivering an average annualized return of approximately 10%. While this long-term performance is encouraging, it's important for investors to understand that these returns are not delivered in a straight line. In fact, they mask a wide range of outcomes that investors have experienced from year to year.

The Reality of Market Fluctuations

While the long-term average is 10%, it's a rare occurrence for the market to return anything close to that figure in a given year. Over the last 99 years:

- Only six years saw annual returns come within two percentage points of that 10% average.

- Annual returns have ranged from +54% to -43%, reflecting periods of exuberance and crisis alike.

- Out of those 99 years, 73 years were positive and 26 years were negative.

This broad range of potential outcomes can feel unsettling—especially during periods of market stress—but understanding this historical context is essential for making sound investment decisions.

Volatility Is Normal—and Manageable

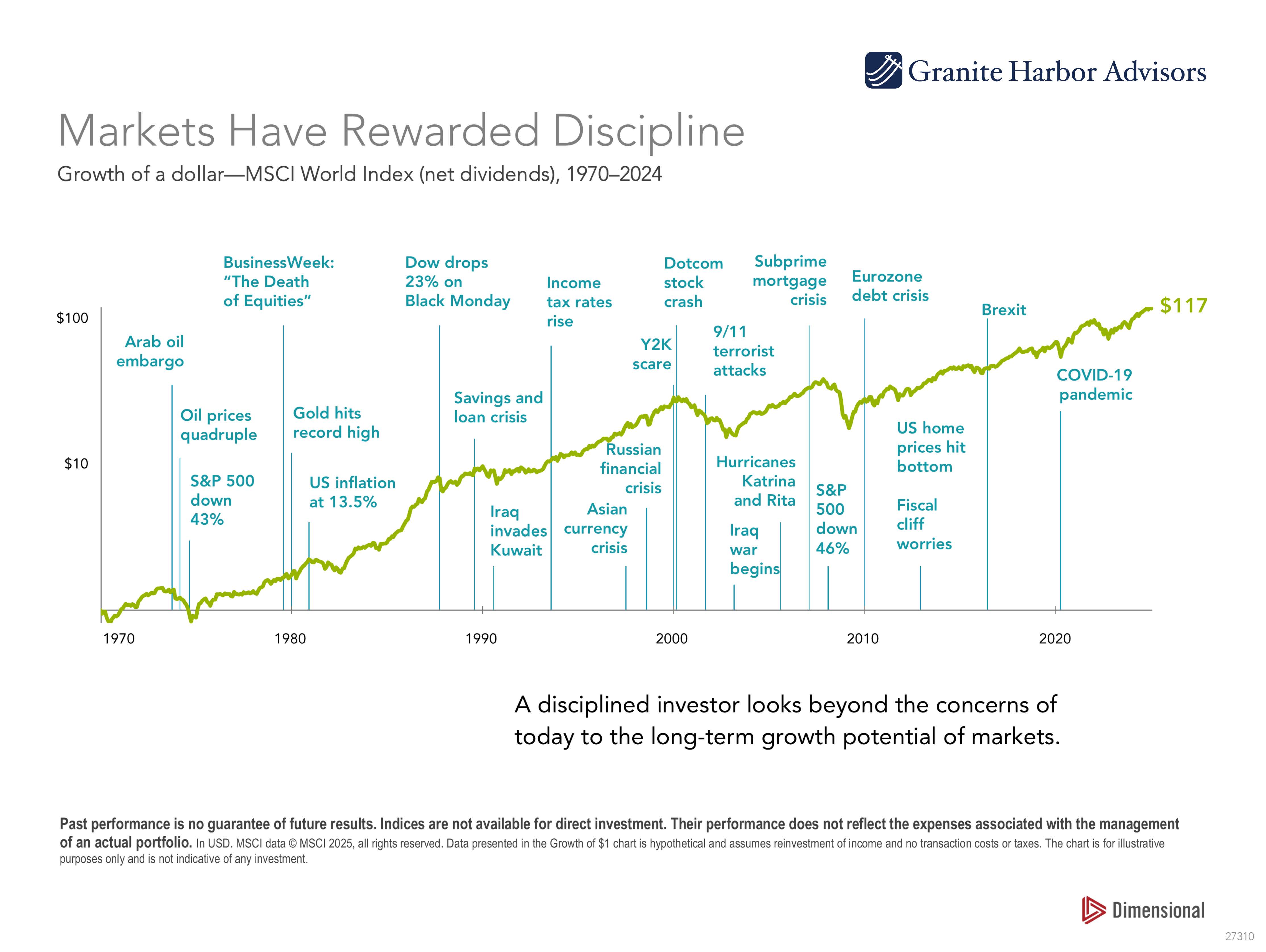

Investors often find themselves tempted to deviate from their long-term strategy during volatile periods. However, as history consistently shows, the short-term unpredictability of markets is the price we pay for long-term growth.

In years when returns soar well above the average, it can be tempting to chase performance or increase risk exposure. Conversely, during down years, fear may drive investors to exit the market prematurely. Both behaviors can be detrimental over time. Investors who remain disciplined and adhere to a thoughtfully designed investment plan are more likely to benefit from the market’s long-term trajectory.

Staying Invested Pays Off

The stock market's long-term resilience underscores a vital truth: Time in the market is more important than timing the market. Reacting emotionally to short-term noise can result in missed opportunities. For instance, many of the strongest market rebounds have occurred shortly after major downturns—often when sentiment is at its lowest.

By staying invested and focused on long-term goals, investors give themselves the best chance of benefiting from compounding growth, dividend reinvestment, and strategic rebalancing.

Planning for the Unexpected

Incorporating market variability into your financial plan is not just prudent—it’s essential. We believe a sound investment strategy should be:

- Globally diversified to reduce exposure to any single market or asset class.

- Aligned with your risk tolerance and time horizon.

- Monitored and adjusted regularly, not reactively.

Understanding the range of potential outcomes equips you to stay calm during downturns and remain invested through recovery. This perspective fosters resilience and discipline—key attributes of successful investors.

Final Thought

The data since 1926 tells a compelling story: while individual years can be wildly unpredictable, the long-term trend of the U.S. stock market has been upward and rewarding. By embracing a long-term perspective and committing to a disciplined strategy, investors can ride out the inevitable ups and downs—and stay on track to meet their financial goals.

If you would like help evaluating your current strategy in light of market volatility, reach out to Granite Harbor Advisors. A well-structured plan can help bring clarity and confidence, no matter what the market brings next.