6 minutes read

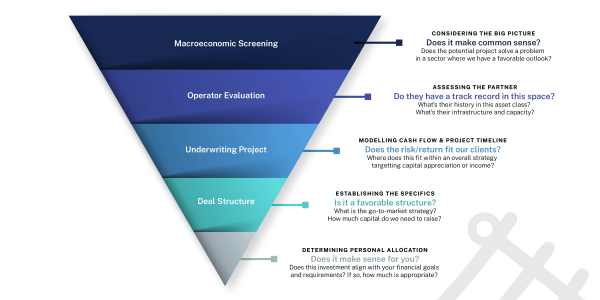

Private Market Investments in High-Net-Worth Portfolios

Authored by: Derek J. Taylor

For high net worth investors, portfolio construction extends well beyond traditional public markets. While public equities and fixed income remain foundational, they are increasingly insufficient on their own to address the complexity of modern wealth objectives—capital preservation, long-term growth, income generation, and downside resilience across market cycles.

At Granite…

.jpg)

.jpg)

Rollovers (1).png)