The media cycle is relentless. From morning talk shows to 24-hour business news, there’s a constant drumbeat of market commentary that can rattle even the most seasoned investors. On one screen, there’s a warning about an impending recession. On another, a pundit claims this year’s “must-own” stock is already doubling in value. For investors trying to protect and grow their wealth, this information overload can feel overwhelming.

But here’s the truth that rarely makes headlines: successful long-term investing has far less to do with reacting to the news and far more to do with disciplined planning, intentional decision-making, and a focus on what you can control.

At Granite Harbor Advisors, we help our clients navigate these challenges with clarity and confidence. That begins with a critical mindset shift — one that favors thoughtful planning over media-driven reaction.

The Illusion of Urgency

Headlines are often engineered to provoke action. News organizations depend on clicks and views, and nothing drives engagement like anxiety or excitement. Whether it’s fear of a market crash or enthusiasm about a new tech IPO, the message is the same: act now or you’ll regret it later.

But the reality for most high-net-worth families and business owners is very different. Your financial future won’t be determined by today’s news cycle. It will be shaped by the consistency of your decisions over time — how you allocate resources, how you plan for taxes and estate transfers, how you think about risk, and how you adapt to life’s inevitable changes.

Chasing headlines often leads to overtrading, mistimed exits, or speculative investments that do not align with your long-term goals. In contrast, staying focused on a disciplined strategy, even in periods of volatility, allows for steadier progress and lower stress.

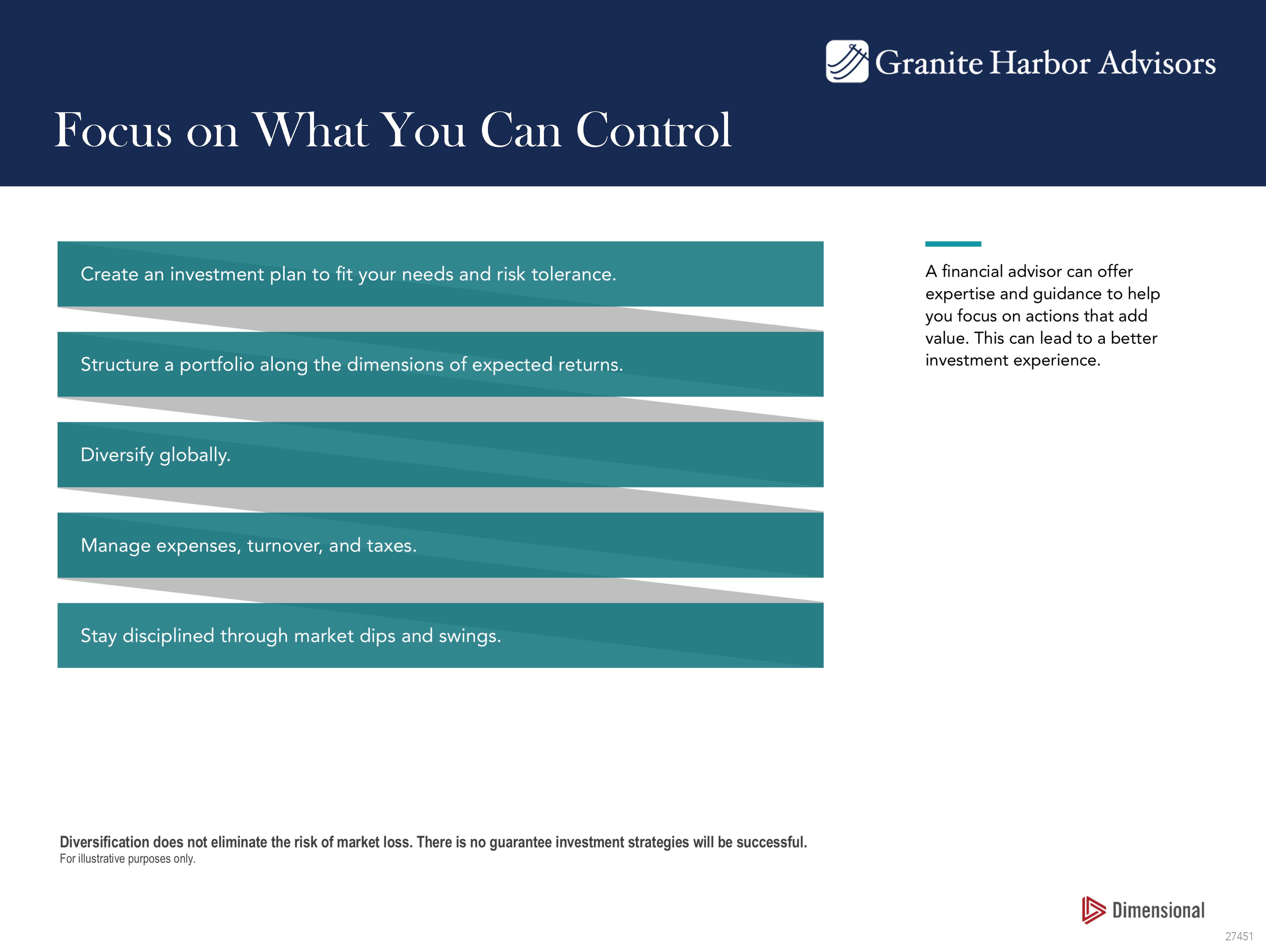

A More Constructive Focus: What You Can Control

While market performance is unpredictable, there are several levers you can reliably influence within your broader financial plan:

1. Crafting an Investment Plan That Aligns With You

Every portfolio should begin with a tailored investment plan built around your personal goals, time horizon, and risk tolerance. This isn’t just about choosing aggressive or conservative strategies—it’s about understanding your specific financial picture and designing an approach that supports your vision of success, while minimizing stress along the way.

2. Structuring Portfolios to Target Expected Returns

Markets have historically rewarded investors who consistently focus on areas of higher expected returns—such as small-cap, value-oriented, and profitable companies. A structured approach allocates capital toward these dimensions, aiming for long-term growth rooted in empirical research rather than speculation.

3. Diversifying Beyond Borders

A well-diversified portfolio isn’t just about spreading risk across industries—it’s also about expanding across geographies. Global diversification may reduce exposure to any single country’s economic cycles, currencies, or political environments, offering a more stable path to building wealth over time.

4. Managing Costs, Turnover, and Tax Efficiency

Even modest reductions in fees, trading costs, or taxes can significantly enhance long-term outcomes. Thoughtful portfolio design—focused on low expense ratios, tax-aware strategies, and minimizing unnecessary turnover—may help preserve more of what you earn.

5. Staying Disciplined When Markets Get Uncomfortable

Perhaps the most powerful advantage an investor can maintain is discipline. Markets will always have ups and downs, but emotional reactions often lead to costly mistakes. Having a clear plan, and the support of an experienced advisor, can help keep your strategy on track, especially when the noise is loudest.

Each of these elements reflects a core belief at Granite Harbor Advisors: long-term success is rarely about timing markets—it’s about thoughtful planning, consistent execution, and staying grounded in what you can control.

Consider the Source — and the Stakes

Financial headlines rarely come with full context. When a commentator declares, “Markets are crashing,” what does that mean for your portfolio, which may include hedges, private equity, or long-term municipal bonds? When a media personality claims that “this is the trade of the decade,” how does that fit into your family’s multi-generational wealth transfer goals?

More importantly, what is the motivation behind the message? Media outlets are not in the business of fiduciary responsibility. Your financial plan should not be shaped by soundbites.

At Granite Harbor, we bring the full strength of our team — not just an individual — to evaluate decisions in the context of your entire financial picture. We understand that our clients are not simply looking to “beat the market.” They want to reduce complexity, preserve capital, and create enduring value for future generations.

Building a Strategy That Works in All Markets

Periods of market volatility can present some of the best opportunities for those who are prepared. For example:

- A market correction may enable strategic Roth conversions at lower tax cost.

- A down market may present more favorable valuations for private investments.

- Lower equity prices may improve estate planning strategies, such as gifting or GRATs (Grantor Retained Annuity Trusts).

These strategies are not born out of reaction — they are implemented through foresight, planning, and collaboration. By maintaining a long-term perspective and working with a team that understands the nuances of both public and private opportunities, investors can turn short-term turbulence into long-term advantage.

The GHA Difference

At Granite Harbor Advisors, we are more than portfolio managers. We are comprehensive financial stewards, deeply committed to our clients' lives and legacies. What distinguishes us is not only the strength of our team and the breadth of our resources, but our disciplined approach to planning, risk management, and tailored solutions.

When others may react, we remain grounded. When others chase returns, we refine strategies. And when others feel overwhelmed, our clients feel empowered — because they know they have a plan, a partner, and a purpose guiding their financial journey.