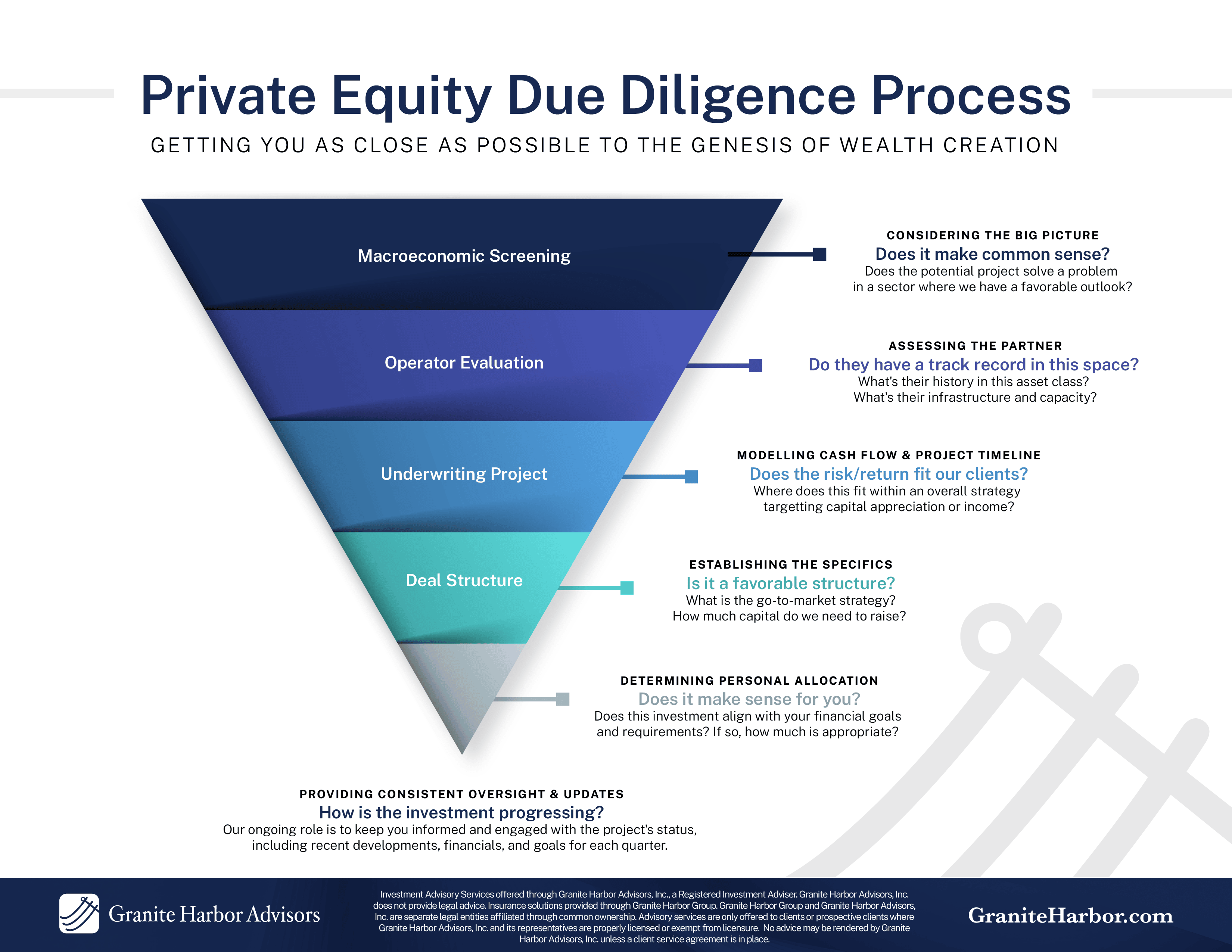

Private Equity Due Diligence Process

Private equity investments offer the potential for significant returns, but they also carry a considerable amount of risk. Therefore, conducting a thorough due diligence process is crucial to evaluate the viability and suitability of these opportunities.

We have constructed a robust infrastructure that allows us to bring private equity opportunities directly to you, ensuring a more transparent and efficient investment process. Our team consists of highly skilled professionals, including attorneys, accountants, tax experts, and audit specialists who specialize in the private equity sector. Before any deal reaches accredited investors for consideration, it undergoes a rigorous vetting process, helping to ensure that only reputable and promising opportunities are presented.

Step 1: Considering the Big Picture

Before delving into the specifics of a potential investment opportunity, it is essential to assess its alignment with the broader investment strategy. Our team evaluates whether the project addresses a problem in a sector that aligns with a favorable outlook. This analysis involves examining the common sense behind the investment and its potential impact on the overall portfolio.

Step 2: Assessing the Partner

The track record and expertise of the partner involved in the private equity deal are crucial factors to consider. Evaluating their history within the asset class provides insights into their ability to generate returns and manage risks effectively. Additionally, understanding the partner's infrastructure and capacity helps determine their capability to execute the investment strategy successfully.

Step 3: Modeling Cash Flow & Project Timeline

To assess the risk and return potential of an investment opportunity, modeling cash flow and projecting the project timeline is essential. This step involves evaluating the investment's fit within the overall strategy of targeting capital appreciation or income.

Step 4: Establishing the Specifics

Once the viability of an investment opportunity has been determined, it is crucial to dive deeper into the specifics. This involves evaluating the investment structure, the go-to-market strategy, and determining the amount of capital required to fund the project. By examining these factors, investors can ensure that the investment opportunity aligns with their preferences and objectives.

Step 5: Determining Personal Allocation

Investing in private equity requires aligning the opportunity with an investor's financial goals and requirements. It is essential to evaluate the suitability of the investment and determine the appropriate allocation. We help investors with this step to ensure that the investment aligns with their risk appetite, financial objectives, and long-term plans.

Step 6: Providing Consistent Oversight & Updates

Once an investment has been made, ongoing oversight and regular updates are crucial. Investors need to stay informed about the progress of the investment, including recent developments, financial performance, and goals for each quarter. This ensures that investors remain engaged and aware of any changes that may impact the investment's performance.

Conclusion: Streamlining Private Equity Due Diligence for Informed Investment Decisions

Private equity due diligence is a meticulous process that involves assessing various aspects of an investment opportunity. By considering the big picture, evaluating the partner, modeling cash flow, establishing the specifics, conducting macroeconomic screenings, determining personal allocation, and providing consistent oversight, investors can make informed decisions and maximize their chances of success. At Granite Harbor Advisors, we prioritize transparency and offer a comprehensive due diligence process to bring private equity opportunities closer to investors, facilitating wealth creation in a more accessible and efficient manner.

Consider the potential of higher returns and contact us today to learn more about the benefits of private equity.

FEATURED RESOURCE

Pros and Cons of Private Equity Investing: What You Need to Know as a High-Net-Worth Investor

This commentary reflects the personal opinions, viewpoints and analyses of the Granite Harbor Advisors, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Granite Harbor Advisors, Inc. or performance returns of any Granite Harbor Advisors, Inc. client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Granite Harbor Advisors, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.