In the realm of private equity investing, a comprehensive understanding of the intricacies of the J-Curve is essential for investors aiming to optimize their portfolios. The J-Curve serves as a graphical representation of the typical return trajectory experienced by private equity funds, illustrating the initial dip in returns followed by a substantial rise as investments mature. This phenomenon is pivotal in strategic planning and decision-making for stakeholders navigating the private markets.

Understanding the J-Curve

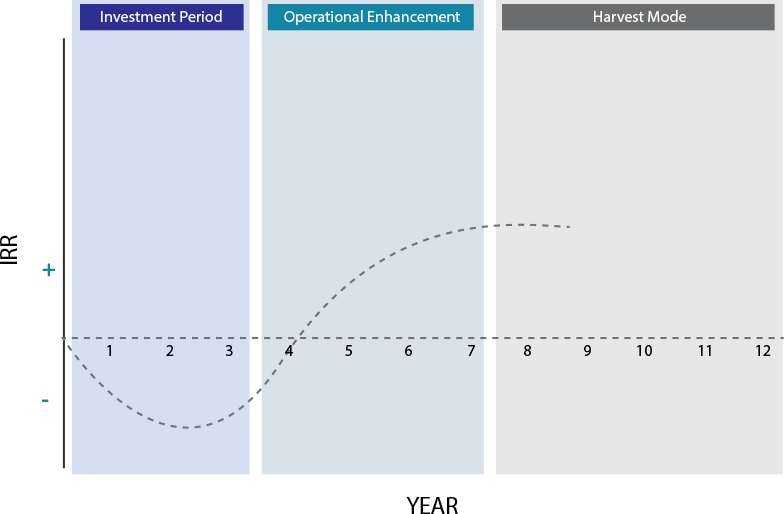

At the inception of a private equity fund, expenses associated with sourcing, managing, and developing investments lead to early-stage negative cash flows, resulting in a dip below the starting point on the curve. This period, known as the "trough," can be challenging; however, it is a necessary phase during which fund managers implement their investment strategies. A "J-Curve" effectively illustrates the performance trajectory of a traditional private equity fund investment: the return curve initially dips into negative values, reflecting these early-stage investments and expenses.

As the investments mature, the curve ascends into positive territory, forming a pattern reminiscent of the letter "J." This upward trajectory represents the potential of private equity, offering significant returns on investment for those who exhibit patience, strategic foresight, and a willingness to accept the risks inherent in private investments. The trough of the "J" curve signifies the negative cash flows experienced by limited partners during the initial phase. In theory, positive returns are realized after all companies exit, and the fund distributes money to limited partners prior to closing. This model underscores the importance of patience and strategic planning in private equity investments, providing a comprehensive understanding of the expected financial journey.

Factors Influencing the Shape of a J-Curve

It is essential to recognize that J-Curves do not universally exhibit the same characteristics; the downward slope of the J can differ in both length and depth, resulting in various shapes. Several critical factors influence the specific contour of an asset's J-Curve:

Time – The duration required for a private equity manager to effect substantial improvements in a business significantly impacts the shape of the J-Curve. This aspect is particularly pertinent when analyzing the Internal Rate of Return (IRR), which is often utilized as the vertical axis in private equity performance charts. The IRR employs a discounted cash flow methodology, taking into account the time value of money. An extended improvement period for a private equity manager leads to a longer and deeper downward slope of the J-Curve. In contrast, if financial enhancements occur rapidly, the downward trajectory may be shorter and shallower, potentially resulting in a steeper upward movement at the tail of the “J.”

Market Conditions & Private Market "Beta" – Throughout the life cycle of a private equity fund, the private companies within its portfolio are typically evaluated on a quarterly basis. Three primary inputs are critical for assessing a private company:

- Public Equity Comparable Valuation: This process involves comparing a private company to publicly traded counterparts within the same sector.

- Discounted Cash Flow Valuation: This methodology evaluates companies based on cash flow valuation metrics.

- Comparable Sales Valuation: This entails comparing a private company to a similar entity within the same sector that has been sold during the relevant quarter.

Fluctuations in public market conditions, whether due to increased interest or significant declines, can immediately impact private company valuations, thereby influencing the J-Curve early in the fund's life. Additionally, substantial variations in cash flows—such as the acquisition or loss of a major client—can similarly affect the shape of the J-Curve. Furthermore, if a comparable company within the same sector undergoes a sale or completes an IPO, the J-Curve can experience immediate repercussions. Notably, a fund that is more sector-focused—such as one concentrated on Enterprise Software—may see a more pronounced sensitivity in the J-Curve's shape to private market beta, as portfolio companies respond concurrently to sector-driven valuation inputs.

Conclusion

In conclusion, navigating the intricate landscape of private equity investing necessitates a comprehensive understanding of the J-Curve and the myriad factors that shape its form. By acknowledging the initial challenges posed by negative cash flows and the subsequent potential for significant returns, investors can manage their expectations and strategic approaches more effectively. The J-Curve not only serves as a critical framework for evaluating private equity performance but also underscores the importance of patience, thorough market analysis, and informed decision-making.

We encourage you to schedule a complimentary consultation with one of our Wealth Advisors to discuss your unique situation and explore tailored investment strategies.