Many investors use the average rate of returns as one of their primary metrics for assessing portfolio performance. In your earning years, the average rate is a useful benchmark because most people are focused on total wealth accumulation. But when you enter retirement, the order in which you experience those returns becomes much more important. A bad year or two at the start of retirement could have a disproportionate impact on your total lifetime wealth, even if the overall average rate of returns is more favorable. This is called the "sequence of returns risk" and it can potentially jeopardize your retirement and wealth planning goals if not managed properly. Let's dive deeper into what sequence of returns risk is and explore some ways you can mitigate that risk for your retirement income planning needs.

What is sequence of returns risk?

Sequence of returns risk, sometimes called sequence risk, is the risk associated with the order in which you experience your investment returns. This risk is heightened in a withdrawal period (aka retirement) when you are living on savings and investments and don’t have income from employment to offset losses and maintain cash flow. If you have low or negative returns in the first few years of retirement versus having those bad years near end of life, the outcome of your portfolio experience can be much different even though your average rate of return may be the same.

If a significant percentage of your portfolio is composed of asset classes that are more volatile, sequence of returns is one of the biggest risks that you need to factor into retirement income planning.

How it can impact your portfolio

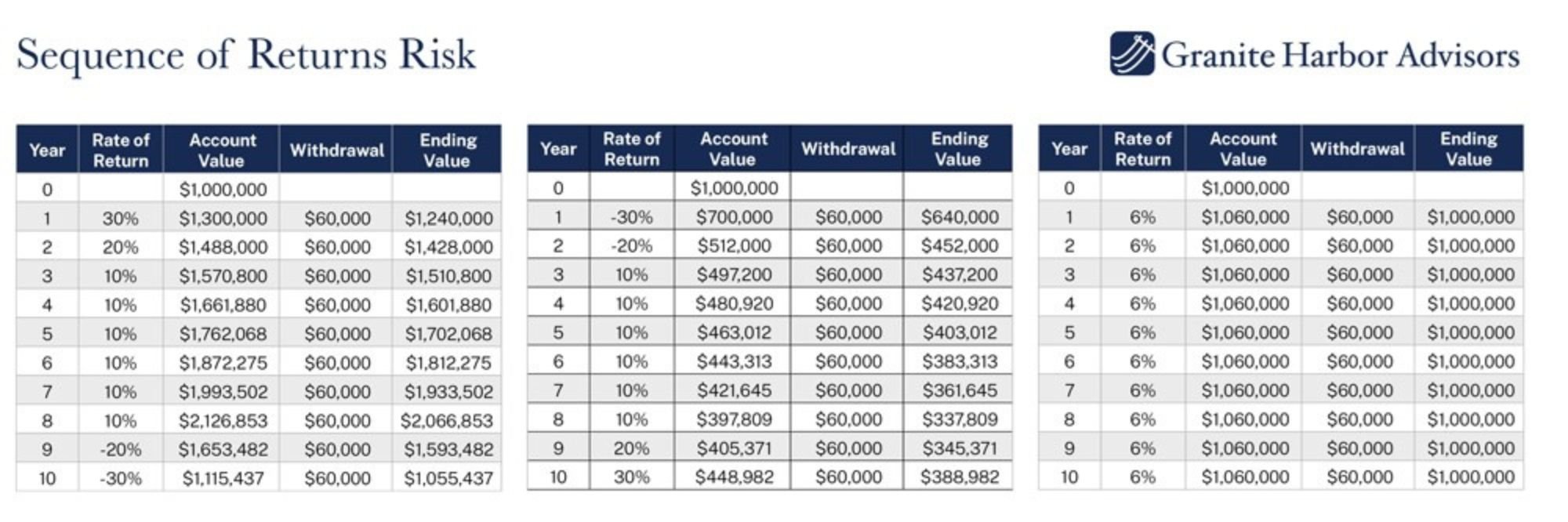

To better understand how sequence of returns risk could impact a large portfolio, let’s look at a hypothetical example that shows why your average rate of return isn’t the best measure when it comes to retirement income planning.

The following chart shows three very different outcomes for a $1M account experiencing a 6% average annual rate of return with $60,000 in annual withdrawals over a 10-year period:

How to mitigate sequence of returns risk

You can’t control the market, so you can’t control your returns. But you do have influence over portfolio diversification, taxes, fees, and your own investing behavior. Of these factors, diversification is one of the most important for mitigating sequence of returns risk.

You need to ensure you have a good mix of stable value assets you can rely on for income while still maintaining strong income potential. If you have an adequate allocation of stocks, bonds, and other asset classes, you have greater flexibility to decide where income is being generated based on the sequence of returns you actually experience.

When the stock market is doing well and outperforming bonds, investors generally elect to rebalance out of stocks to maintain desired portfolio allocation balance, thereby creating a source of cash. But when the stock market is performing poorly and you would ideally be a net buyer of stocks, stable assets like bonds can provide the cash flow you need to avoid selling undervalued assets and maintain strong potential for growth.

You may also want to consider how your general approach to retirement income planning accounts for sequence of returns risk. Many investors focus on yield and what that means for their available income. But one way to mitigate sequence of returns risk is to take a total return approach which includes capital appreciation and income from interest or dividends. With this perspective, you don’t have to worry so much about spending down principle in any given year as long as your total return is keeping up with our total withdrawal rate over time.

There is also an emotional component to managing sequence of returns risk. Poor returns early in retirement could cause an individual to sell devalued assets prematurely or become overly conservative and put too much money into stable asset classes like bonds, limiting the possibility of future growth. Investors should consider all possibilities and how various situations might affect them from an emotional standpoint. Putting a plan of action in place now when you are thinking clearly and objectively can help you develop a plan to avoid emotional reactions that jeopardize your financial goals.

Retirement planning that accomplishes your goals

One of the biggest risks associated with retirement income planning is the sequence of returns. Yet it often goes overlooked during retirement income planning. By fully understanding the scope of the risk and how you can mitigate it with active wealth management, you can develop a plan and a portfolio well-suited to protect your financial future.

If you’d like to discuss your retirement income plans with a financial professional, contact us and we can schedule a call to review your current strategy and how we can help you achieve your most important goals.