The Fund targets value‑add and growth-oriented private equity, real estate, and private credit opportunities, including lower-middle-market businesses operating in manufacturing, distribution, or other branded or differentiated products or processes, as well as commercial real estate investments in the multifamily, industrial, healthcare, targeted hospitality or other value-add asset classes, and up to 20% in private credit supporting growth capital needs for the above businesses or investment opportunities.

.png)

Request Additional Information About Mariner Fund I

If you’re interested in learning more about the Granite Harbor Capital -- Mariner Opportunity Fund, please complete the form below. A member of our team will reach out with additional information shortly!

Institutional - Quality Private Market Opportunities - Beyond Piecemeal Investing

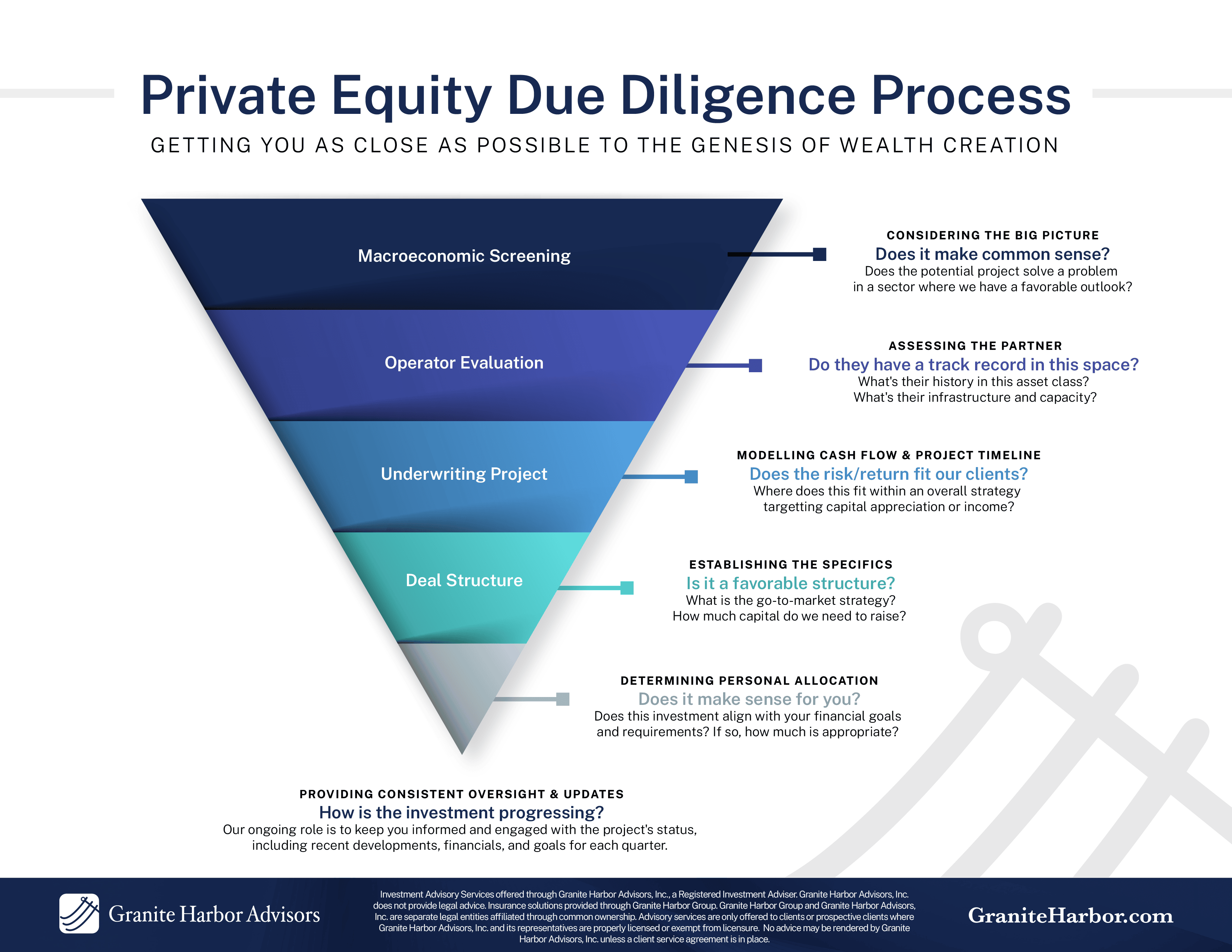

Mariner Fund I is an opportunity fund that gives access to select private market deals with the goal of enhancing long-term return potential & improving diversification beyond traditional public markets. With a single commitment, investors gain access to a curated portfolio of opportunities, each sourced, due diligenced, and actively overseen by experienced operators.

Introducing The Mariner Fund

Managing Partners Nick Brown and Derek Taylor introduce Mariner Fund I, marking Granite Harbor Capital's expansion into private markets through a purpose-built opportunity fund. Derek brings a unique blend of experience as a transactional attorney, private equity investor, and owner-operator—shaping an operator-led investment approach rooted in direct sourcing, disciplined underwriting, and active involvement post-close. Together, they explain why Granite Harbor created Mariner Fund I, how off-market and co-GP investments bring investors closer to the source of value creation, and why the Central U.S. offers compelling, often overlooked opportunities.

Investor Benefits

Unique Access

Cost Efficiency

Time Leverage

Diversification

.png)

What Investors Get:

- Diversified exposure across private equity & real estate.

- Access to off-market and co-GP opportunities not found on traditional RIA or broker-dealer platforms.

- Investments in growth-oriented, lower middle market businesses ($1–$10M per deal).

- Governance and oversight from seasoned operators and PE professionals.

.png)

How It Works:

- One investment provides access to a portfolio of fully due diligenced opportunities.

- Direct deal sourcing and structuring from an experienced team.

- Each deal is evaluated through the lens of an RIA with operating experience.

Profile of Target Investments

A Focus on Private Equity & Real Estate Investments

Private Equity

- 40-50% Fund Target

- Target Revenues:

$10-$100M - Targeting Differentiated Manufacturing, Infrastructure Support, and Logistics

- Make significant minority or controlling investments with board positions

- Providing capital and management expertise for businesses looking to scale

- Exit opportunity to upline PE Managers looking for a ready-made investment opportunity

Real Estate

- 40-50% Fund Target

- Development or Investment Values:

$5-$100M - Target Sectors: Multi-family Housing, Healthcare, Targeted Hospitality

- Investments in projects under development or targeted value-add acquisitions

- Exit to REITs or private sponsors seeking stabilized, income-producing properties.

Sample Opportunities

Project Freedom

- Middle market buyout opportunity focused on US manufacturing

- Significant co-investment opportunities

Project Build

- Acquisition of fully constructed multi-family projects in Central US Growth Market

- Value-add opportunity through lease through lease up of a new product

Project Speed

- Logistics based solution in professional sports

- Rapid growth trajectory in a nich and under-represented sector

- Substantial minority investment with board seat

Why Invest in the Central U.S.

Focused on generating attractive returns by investing in central U.S. communities historically underserved by institutional capital - yet

poised for growth driven by large employers.

Alternative Investments. Done the RIA Way

Private markets, backed by real advisory and operating business experience

While most RIAs stay at the asset allocation level, we've stepped into the operator's seat, sourcing, structuring, and funding alternative investments.

From sourcing to funding, we leverage our unparalleled experience in building and leading:

- Commercial Real Estate Investments

- Operating Businesses (Sourced both directly and/or through Independent Sponsor Private Equity Firms)

To support growing entrepreneurs who stand alongside our investments across numerous industries & geographies.

The Granite Harbor Capital Team

Derek J. Taylor

Managing Partner

Derek Taylor joined Granite Harbor in 2025 to lead Granite Harbor Capital and the launch of the Mariner Fund. He brings a unique blend of legal, private equity, and operational experience to Granite Harbor Capital. After beginning his career as a transactional attorney and equity partner at a national law firm, he transitioned to leading operations for a multi-state private equity real estate firm and co-founding an independent sponsor platform focused on lower middle market companies. He is also the owner-operator of a nationally recognized manufacturing brand in the outdoor living space. Derek and his family are active in their community, where he serves as a Village Trustee. He is also a former Chapter President of NAIOP Wisconsin, including being recognized in 2024 as Chapter President of the Year among the many North American chapters in the same year the Wisconsin chapter won Chapter of the Year for all chapters

Brian W. Sak

Managing Partner

Brian W. Sak leads Granite Harbor Companies, a Houston-based wealth management firm with a focus on delivering strategic, private market access to business owners, executives, and affluent families. Under his leadership, Granite Harbor has expanded its capabilities to help clients integrate private equity, real estate, and direct investment opportunities into their long-term financial plans. A Forbes-ranked advisor and former President of Forum 400, Brian brings deep industry insight and a values-driven approach to simplifying complex financial decisions. He is a sought-after speaker on private markets and legacy planning, known for blending technical knowledge with relatable, client-first communication.

Nicholas M. Brown

Managing Partner

Nick Brown guides the firm’s investment philosophy, portfolio construction, implementation, and monitoring. A firm believer in the role that Private Market investments play in a successful client portfolio, Nick has helped construct multiple access points for alternative investment, including self-sourced direct offerings for Granite Harbor Advisors clients. Nick has a strong commitment to ongoing education, reflected in the fact that he is both a CFA™ Charterholder and holds the Certified Financial Planner™ designation. This makes him uniquely positioned to bring together both programs' rigorous curriculum to better serve the firm's clients. He also received his bachelor’s degree from the Florida Institute of Technology.

Frequently Asked Questions

Mariner Fund I provides qualified purchasers & qualified clients with access to institutional-quality private market opportunities across private equity, real estate, and select private credit generally sourced off-market or through limited market opportunities. With a single commitment, investors gain diversified exposure to curated, operator or sponsor-led deals designed to enhance long-term return potential and portfolio diversification. The opportunities will generally exist with sponsors, investments, or companies located in the Central United States.

Participation is limited to Qualified Purchasers & Qualified Clients, verified during the subscription process, or other accredited investors at the Manager’s discretion.

The Fund is structured for a long-term 10-year investment horizon aligned with private market value-creation cycles, where the Fund Manager will seek investment opportunities which target a 5-year investment cycle.

The Fund is designed for clear reporting and tax-efficient structuring. Investors receive periodic reporting and annual tax documents. The Fund Manager will work with operators or sponsors to identify and pass along to eligible investors tax benefits from investments, such as depreciation, active or passive losses, or other long-term tax strategies.

Opportunities are sourced through extensive operator, sponsor, and industry networks, focusing on off‑market, co‑GP, and/or co-investments deals not available through traditional RIA platforms.

Mariner Fund I is managed by Granite Harbor Capital, with oversight from leaders experienced in private equity, real estate, and operational execution.

No. Investments are illiquid and involve multi‑year lockups. The Fund is not suited for short‑term liquidity needs.

The team applies a multi‑stage review, including geographic and investment thesis strategy fit, operator or sponsor evaluation, financial and structural analysis, risk assessment, and legal/compliance review with professional partners. When available or advisable, the team will also inquire about serving as an advisory board member to continue to guide the operator or sponsor through the investment horizon.

Private market risks include illiquidity, capital loss, market volatility, operational risks, and extended time horizons. These investments are not appropriate for investors requiring short-term access to capital. A more complete assessment of the risks associated with fund can be found in the PPM.

The process includes eligibility verification, disclosures, funding instructions, and onboarding support from the Granite Harbor team.

Investors receive periodic (quarterly) fund updates, project-level updates, and annual capital account statements and tax documentation.

While primarily focused on direct private equity and real estate investments, the Fund may allocate up to 20% toward private credit opportunities aligned with its strategy or may make co-investments alongside other funds or within a particular fund identified by the team as an investment otherwise meeting the strategic investment thesis.

The Fund features a management fee of 2% per annum on invested capital. This streamlined fee structure covers sourcing, diligence, governance, and administration. Performance fees are assessed over and above this once target IRRs are achieved. Full details are provided in the Fund’s PPM and subscription materials.

The Fund features a streamlined structure covering sourcing, diligence, governance, and administration. Full details are provided in the Fund’s PPM and subscription materials.*

This material is provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer or solicitation will be made only to qualified investors by means of a private placement memorandum and other offering documents, which should be read in their entirety. Private investments are highly speculative, illiquid, may involve a complete loss of capital, and are not suitable for all investors. Past performance is not indicative of future results. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity. Private investment services offered through Granite Harbor Capital, LLC, an Exempt Reporting Adviser. Mariner Capital Opportunity Fund, LP is not and will not be registered under the U.S. Investment Company Act of 1940 or the Securities Act of 1933.