The Impact of Presidential Elections on the Stock Market

Investors often ponder the connection between elections and stock market performance, whether it's during mid-term elections or presidential elections. This topic tends to resurface every election year, sparking discussions and analysis among market participants. Whether you're a novice dipping your toes into the world of investing or a seasoned pro, understanding this correlation can provide valuable insights for your investment strategy.

Presidential Policies and the Stock Market

Presidential policies can have profound impacts on the economy and, by extension, the stock market. Tax reforms, trade agreements, regulations on industries – all these decisions can influence business profitability and investor sentiment. However, it's important to note that while the president plays a significant role, they are not the sole determinant of economic outcomes. Other factors like global events, technological advancements, and demographic shifts can also sway the market.

Historical Trends and Patterns

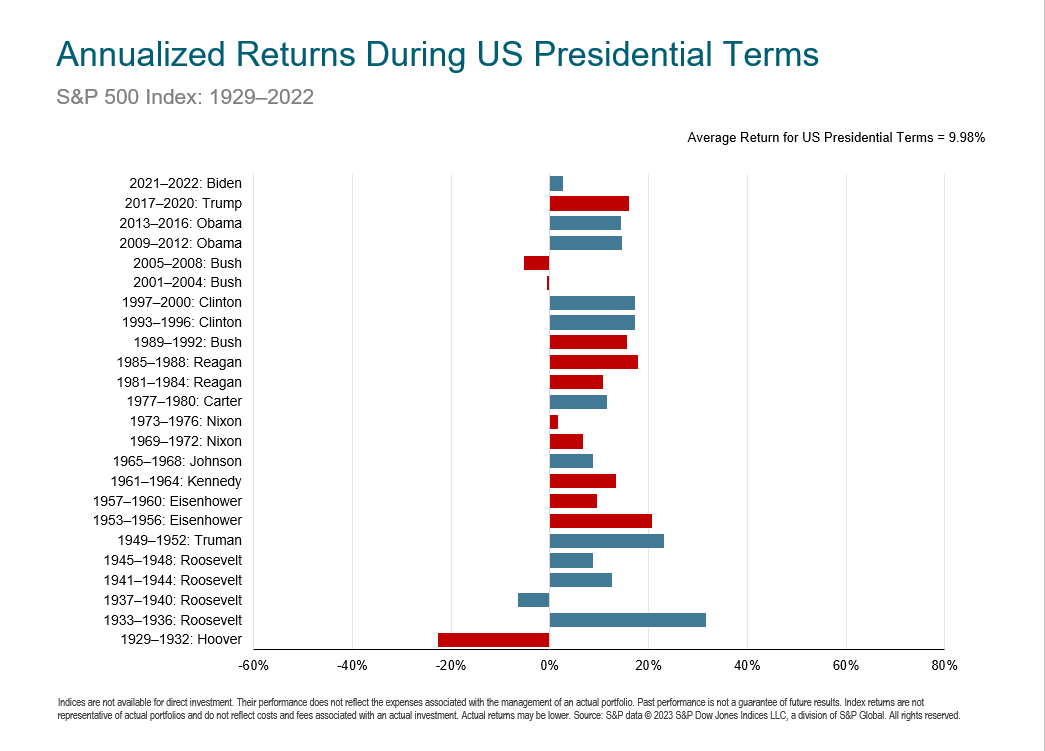

There's a common belief that the stock market performs better under one political party than the other; with most people believing that their preferred political party has the more positive outcome. However, data as shown in the following Dimensional Fund Advisors graph suggest that markets have delivered strong returns under both Democratic and Republican administrations[1][2], indicating that long-term market performance is not solely dependent on the president's party affiliation.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Actual returns may be lower. Source: S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved

Investor Approach to Presidential Elections

Given this information, how should investors approach presidential elections? Here are some recommendations:

- Stay Informed, Not Influenced: Stay informed of political developments and potential policy changes, but don't let them dictate your investment strategy.

- Long-term Perspective: Remember that investing is a long-term game. Short-term volatility, while potentially unnerving, should not deter you from your long-term financial goals.

- Diversify: Spreading your investments across different asset classes can help mitigate risk during periods of uncertainty.

In conclusion, while presidential elections do influence stock market volatility, they do not represent the entirety or ultimate measure of market performance. Sound investment strategies, rooted in thorough research and a long-term perspective, are key to navigating any market conditions.

If you have questions about your strategy or other concerns surrounding today’s market, give us a call at 832-461-0789 or schedule a consultation with one of our advisors to discuss your needs.