Combining Public and Private Markets Together

Publicly Traded Securities Are Only a Fraction of the Opportunity

Access unique opportunities for wealth creation through our private markets investments tailored specifically for accredited investors and qualified purchasers. Our exclusive investment offerings are designed to offer you unparalleled access to private credit, real estate, venture capital, and M&A opportunities outside of the public stock and bond markets.

Our Investment Philosophy

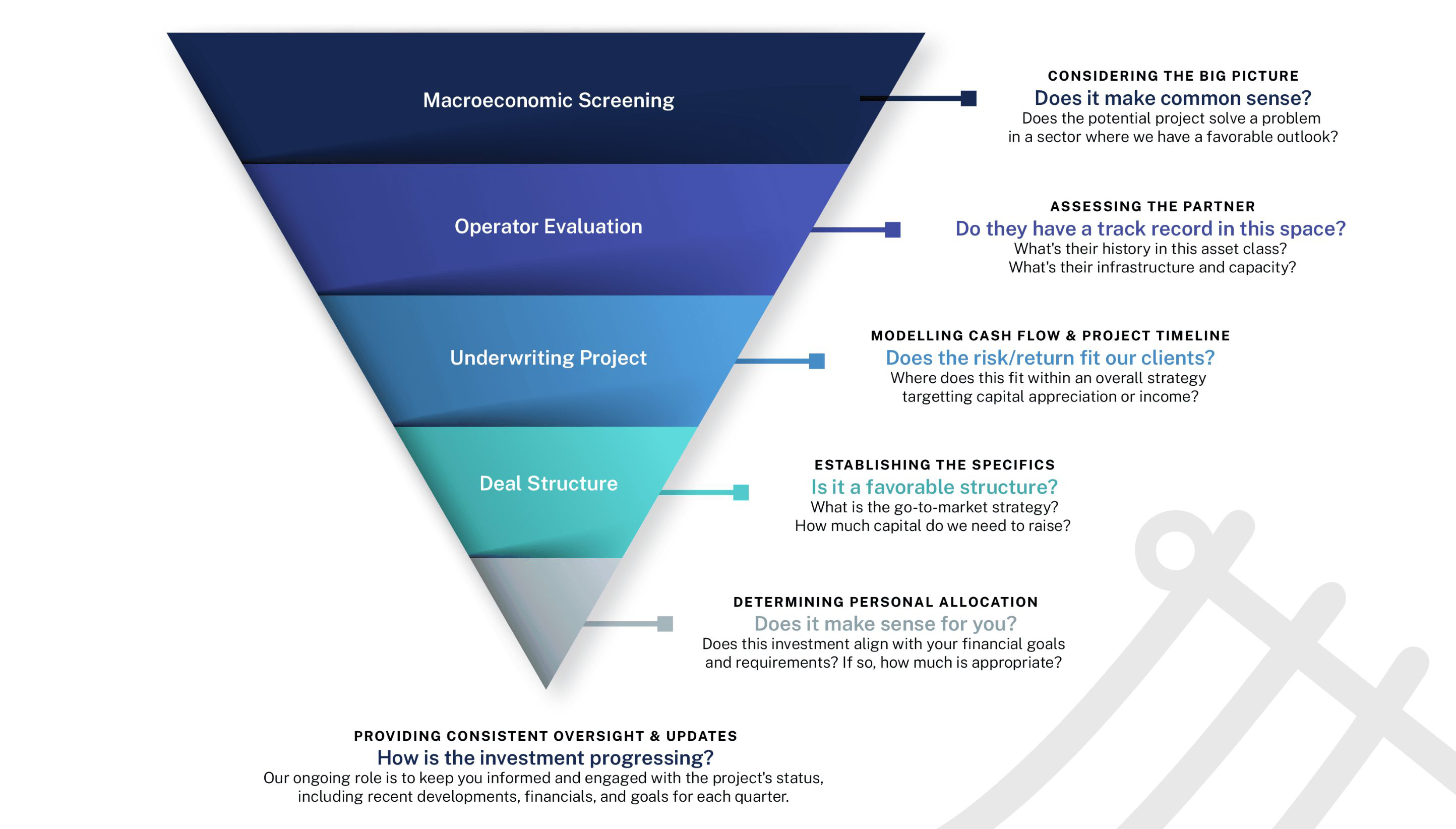

A Strategic Approach to Your Financial Goals

Private Market investments have grown to a multi-trillion-dollar asset class in recent years gaining in popularity among accredited investors. As a Registered Investment Adviser (RIA) firm, we are committed to identifying investment opportunities to help our clients reach their financial goals. As such, we are uniquely positioned to deliver a fresh perspective on a broad range of today's most desirable asset classes, including those in private markets. We classify these opportunities into three broad categories:

- Private Credit

- Real Estate

- Private Equity, Venture Capital, and Mergers and Acquisitions

While investing in private opportunities carries considerable risks, these exclusive investments can be a great way to increase non-correlating assets to a marketable securities portfolio. We work diligently to determine beneficial opportunities that align with each investor’s profile and objectives.

Benefits of Private Market Investing for Accredited Investors

Unlock Exclusive Growth Opportunities and Diversify Your Portfolio

Higher Potential Returns

Diversification From Public Market Investments

Early-Stage Entry Points

Access to Unique investment Opportunities

Control and Involvement in Investment Decisions

Long-Term Focus on Growth and Stability

Our Commitment

Your Path to Financial Success: What to Expect Next

At Granite Harbor, we adopt a proactive approach to investment management, staying actively engaged and serving as a reliable resource for investors throughout the investment journey. With regular quarterly updates, we ensure investors are well-informed about the progress of all of their investments, both in the public and private markets. We create a seamless experience to incorporate all areas of the global capital markets for our clients

We also prioritize long-term success with each private market investment opportunity, keeping the end in mind. For each new venture, we identify an exit strategy with a tentative timeline prior to moving forward. Moreover, upon liquidation, we work closely with investors to optimize returns in a tax-advantaged manner and adjust their investment portfolio strategy to align with their individual goals, risk tolerance, and time horizon.

Resources for Private Markets

A Selection of Granite Harbor Resources Focusing on Private Markets

Are We Mistaking Index Performance For Diversification?

The Ultimate Guide to Private Market Investing

The Rise of Private Debt in Financial Markets

Navigating the Investment J-Curve with Confidence: A Guide to Strategic Private Equity Investing

The Power of a Holistic Approach to Public and Private Equity Markets for Accredited Investors

Ready to optimize your wealth?

Take the first step towards financial success by scheduling a 30-minute introductory call with us today.