United States Army veteran William Victor Roth will forever be remembered for creating one of the most utilized tax-savings tools available. During his 30-year career as a US Senator, he pioneered a new retirement savings vehicle, the Roth Individual Retirement Account (Roth IRA), as part of the Tax-Payer Relief Act of 1997. With the previously established “traditional” IRA, the tax benefits are realized immediately in the form of a tax deduction when funds are deposited into the account. However, taxes are due on all funds when they are withdrawn. In a Roth IRA, the significant tax benefits are realized down the road, when funds are withdrawn.

While contributions to a Roth IRA do not qualify for a tax deduction, if certain criteria are met, withdrawals can be tax-free. If contributions are held for the greater of 5 years or the attainment of the age of 59 1/2, all original funds plus growth can be accessed 100% tax-free. This can create an extremely valuable source of retirement income for many individuals.

However, there are income limits on who can participate directly in the program. Taxpayers earning more than those income limits cannot make a direct contribution to a Roth IRA and therefore need to find other ways to take advantage of this valuable program. This can be difficult to do in an ever-changing legislative landscape.

In 2010, the tax laws changed allowing individuals over the income limits to establish the ever-popular “back-door” Roth IRA or “indirect” Roth IRA strategy. Since traditional IRAs don’t have income limits for non-deductible contributions, an individual over the income limits can contribute post-tax income to a traditional IRA then convert it into a Roth IRA. The challenge with the “back-door” Roth, is there are very complicated aggregation rules to abide by if you have an existing pre-tax IRA.

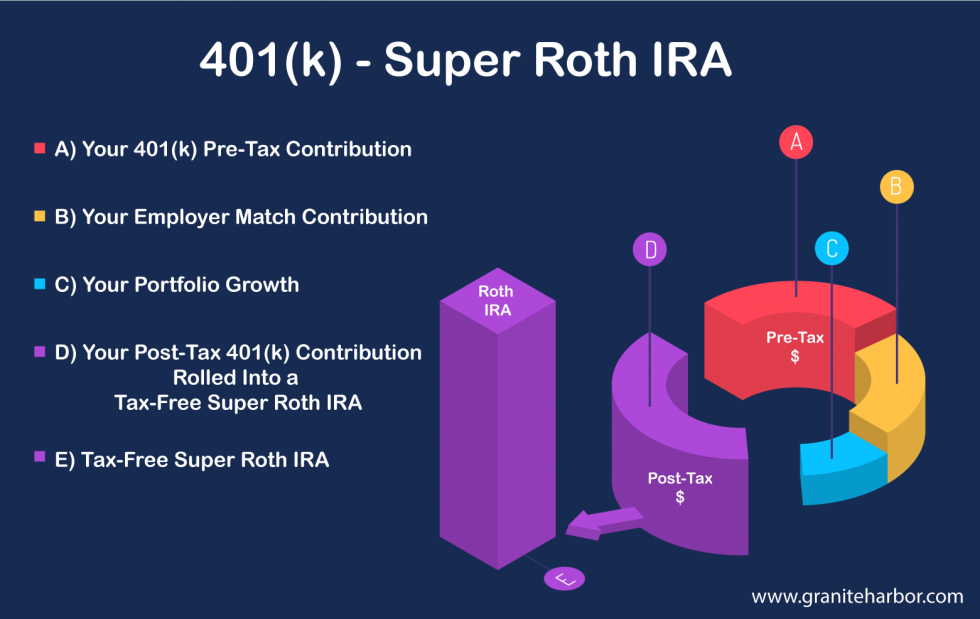

So, what is the alternative to the “back-door” Roth if your income precludes you from contributing directly to a Roth IRA, you participate in a pre-tax IRA or 401(k) program and are subject to the unattractive aggregation rules? The answer is a 401(k) – Super Roth IRA.

Let’s Learn More.

First, most individuals earning over the Roth IRA income limit will want to take advantage of their 401(k) by maximizing the pre-tax contribution into the program, including the benefit offered through any employer matching funds. However, you can only contribute so much in a given year before your pre-tax contributions are capped. But tax laws allow for additional, post-tax contributions to be made to 401(k)’s provided your plan will accept them.

Since 2014, tax law allows these post-tax contributions to be rolled directly into a tax-free Roth IRA. This will “superfund” your Roth IRA and allow you to create one no matter your income. The rules, timing, and amounts used for taking advantage of this can be complicated, but if conducted properly, the Super Roth IRA allows large amounts of money to be contributed into a Roth IRA without significant tax ramifications.